by Ravindra Warang

6 minutes

Top HR Strategies for Successful Pharma Mergers: People, Culture, and Integration 2025

Discover the dynamic role of HR's in pharma M&A which includes cultural integration, workforce management, etc.

The global pharmaceutical industry witnesses more mergers and acquisitions (M&A) activities than any other industry. 2024 alone has seen many major M&A events in the pharmaceutical space. For example, Merck acquired Eyebiotech Limited in July, Thermo Fisher Scientific acquired Olink Holding AB in July, and Johnson & Johnson signed a definitive agreement to acquire Proteologix Inc. in May.

While these M&A activities need to be well handled on the media front, the HR department of pharmaceutical companies also plays a critical role in alleviating employees' stress and conflict during M&A activities.

In a previous article, we highlighted the challenges faced by pharma leadership during M&A activities. On a similar note, this article highlights the challenges faced by HR during M&A. But before diving into that, let's understand HR's role in M&A activities.

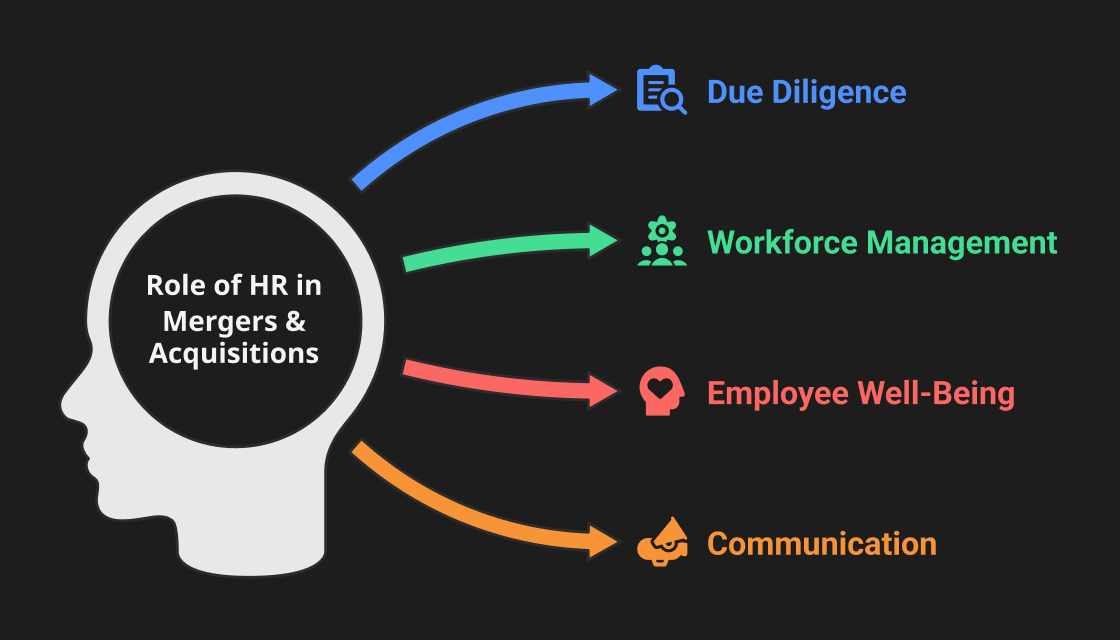

What Is The Role Of HR In Pharmaceutical M&A?

a) Due diligence

The department of HR has several tasks. HR reviews all employee data of both companies, including employment contracts, compensation, and benefits. HR must ensure compliance with labour and employment laws in these contracts. HR harmonises the salary and benefits of all employees in both organisations to ensure they meet the industry standards. In case of any changes to compensation and benefits, HR has to inform all employees and provide explanations and timelines for the changes.

Finally, HR also conducts cultural assessments to understand potential areas of conflict. They have to align the cultures of both companies by developing and implementing change management strategies.

b) Workforce Management

Workforce management includes various roles, as follows:

- HR must identify key employees who are critical to the success of the merged organisation and create plans to retain them.

- HR should develop employee retention plans, e.g., bonuses, incentives, perks, and promotions. These contingency plans must be ready before implementing any organisational changes.

- HR must design a new organisational structure by defining roles, responsibilities and reporting lines. It also includes designing teams according to skillset, experience, and job profile.

- HR must help integrate the workforces of the two companies into one. It includes smoothing the transition from old to new teams and providing resources and support.

- HR must identify redundant roles and manage workforce reduction activities (e.g., cancelling contracts and firing employees).

- HR has to determine severance packages and outplacement services in case of workforce reductions.

c) Employee Well-Being & Support

HR must offer support programs such as counselling services, employee assistance programs, and stress management resources to all employees to help them deal with the change. To this end, HR must also monitor employee morale and engagement using feedback sessions and surveys to identify employees needing support. HR should also promptly identify and address other interpersonal or M&A-related issues for employees.

d) Communication

HR is also responsible for maintaining clear communication in the company. Various rumours circulate during the M&A process, which affects employee morale and company loyalty. To alleviate this, HR must ensure clear communication within the organisation. It includes developing appropriate communication channels and sharing information with employees before it is made public to ensure the company can appropriately handle any fallout. These activities considerably affect employees' well-being, morale, and company loyalty during M&A activities. Hence, HR must handle all situations delicately. However, HR professionals often face various challenges during M&A activities.

A Few Common Challenges For HR In Pharmaceutical M&A

HR faces several challenges during pharmaceutical M&A activities; the most common are as follows:

1) Cultural integration

Merging two companies with distinct cultures is challenging because of their difference in values, work ethics and business practices—poor cultural integration results in low employee morale and high turnover. In global pharmaceutical companies, cultural and language differences can lead to miscommunication and friction, slowing the integration process.

2) Workforce Sustainability

The uncertainty around a merger or an acquisition can lead to attrition among employees who may fear losing status or job redundancy. Losing employees can weaken the merged company's competitive edge and disrupt projects, especially in specialised areas such as R&D and clinical trials.

3) Employee’s Job Security & Role Changes

HR has to handle organisational changes to ensure employee satisfaction appropriately. Poorly managed transitions can lead to attrition or legal issues. Poorly managed layoffs can lead to lawsuits or high compensation demands, harming the company's reputation. HR must also manage employees' concerns about job security and role changes. Poor management of such situations can lead to decreased engagement and productivity or increased attrition.

4) Compensation & Benefits Harmonisation

Merging companies may have different compensation structures and benefit packages. HR must harmonise these to ensure they are fair for all employees. Disparities in pay and benefits can lead to job dissatisfaction and loss of talent.

However, these challenges can be handled by following simple strategies.

Best Practices for Addressing These HR Challenges During Pharmaceutical M&A

Here are a few effective Strategies To Overcome The Previously Mentioned Challenges!

A) Cross-Cultural Fusion — HR should perform thorough cultural assessments of both organisations to identify similarities and differences before a merger. Next, a detailed plan that outlines how the different cultures will be integrated must be created. Next, leadership from both organisations must be involved so they are committed to modelling and reinforcing the desired culture. Finally, employees should be briefed about changes. Transparent communication about cultural changes should be maintained, and all employees should receive regular updates.

B) Leadership Retention — HR must identify high-performing employees who are essential to the organisation during due diligence. HR must develop individual retention plans for these employees. They can offer retention bonuses, stock options, financial incentives, and career development opportunities to retain critical employees.

C) Provide Opportunity To Adapt — Any layoffs or demotions should be well-planned and timed, and employees should be provided with detailed explanations to ensure no legal consequences. Layoffs should be conducted fairly and transparently, and layoff criteria should be communicated and used. In case of demotions, employees should be offered cross-training or skill development opportunities so that they can adapt to their new roles or have the opportunity to be eligible for future promotions. HR should monitor workforce sentiment and address concerns promptly.

D) Benefits Parity — HR should compare organisations' compensation and benefit packages to identify critical differences. Next, a strategy to harmonise these differences should be developed after considering market competitiveness, equity, and employee expectations. Changes in compensation and benefit packages should be implemented in phases to minimise disruption. The reason for changes should be communicated, and FAQs, one-on-one meetings, or education sessions should be held to address concerns.

E) Communication — Clear and honest communication is key to making any merger or acquisition work well. HR is vital in ensuring everyone gets the correct information at the right time. From the start, HR should keep employees updated about what’s happening and what it means for their jobs. This helps reduce confusion and builds trust. HR also needs to allow employees to share their concerns and ask questions. The transition is smoother and more successful when people feel heard and included.

F) Talent Mapping & Role Consolidation — Before a merger or acquisition, HR has an important job to do: check the people's side of the business and plan for the future team. First, HR looks closely at the other company’s policies, employee benefits, pay structure, and whether they follow labor laws. This helps find problems early and spot areas where both companies can work better together.

HR also ensures all local rules are followed so there are no legal issues during the merger. At the same time, they plan how to bring the two teams together to support the new company’s goals. This means looking at both teams' skills, finding overlaps or missing roles, and deciding who fits where. Good planning helps avoid confusion and ensures the new company can start strong after the merger.

G) Post-Merger Integration Planning — To help both companies come together smoothly after a merger, it’s essential to create a shared vision that reflects the values of both sides. This gives employees a clear direction and helps them feel part of one team. HR and leaders should involve employees in building this vision through workshops or discussions so everyone feels included and heard. This also helps in building trust and unity. Leaders must show their support for the vision, not just by talking about it, but by acting on it.

Training also plays a key role. Offer sessions on working across cultures, handling change, and solving conflicts. These skills help employees adjust and work better together. Mentorship programs can make a big difference, too. Pairing employees from different backgrounds encourages learning and helps build strong relationships. Lastly, give employees easy access to helpful tools like online guides, FAQs, and info portals. This allows them to stay informed and confident about the changes in the new organization.

In Conclusion

These strategies can help HR manage the complexities of pharmaceutical M&A and overcome some challenges they face during M&A activities. M&A is a lengthy process, and employees may face anxiety, loss of job security, and redundancy fears at any stage. HR plays a crucial role in identifying and addressing or mitigating these concerns before they can decrease employee morale. HR should always be in touch with employee sentiments, and to this end, it is necessary not only to conduct surveys and feedback sessions but also to talk to them personally.

FAQs

1. What is the biggest challenge for HR during the M&A of two companies?

Most experts believe that cultural integration is the biggest challenge for HR because two companies can have vastly different working cultures, prompting employees to reject changes.

2. What are the legal and compliance issues HR needs to consider during M&A?

HR must ensure compliance with all labour laws and employment laws. To this end, HR may have to review existing employment contracts to ensure they comply with the regulations and draft new contracts for future employees.

3. Which part of the M&A process is HR involved in?

HR is involved in pre-merger activities (e.g., due diligence and communication planning), merger activities (e.g., onboarding and cultural integration), and post-merger activities (e.g., employee support, evaluation, and monitoring).

4. Why Do Mergers Fail Due To HR Gaps?

Mergers often fail due to HR gaps like poor communication, culture clashes, unclear roles, and lack of employee engagement, which lead to low morale and high turnover.

5. How To Retain Top Talent Post-Merger?

Retain top talent by communicating, aligning company cultures, offering growth opportunities, and recognizing and rewarding key employees early on.